-

- June 19, 2017

- 0

Signal Scaling – Volatility Targeting

There is a long path from predictions to traded signals. We discuss one approach in our white paper “A Practitioner’s Defense of Return Predictability,” which was recently published in the Spring 2017 issue of The Journal of Portfolio Management. The paper proposes using a constant multiple of forecasts, with some adjustments, to arrive at the size of portfolio positions. While this approach allows us to target a return-risk profile, it does not allow us to match portfolio risk with benchmark risk.

We have recently researched a method for providing volatility matching of our strategy to that of the market. We calculate the target standard deviation as a long term moving average of stock market volatility and divide it by the long term running standard deviation of our unscaled portfolio. This provides a scaling factor which we apply to our original signal. One question we had when studying this approach was how invariant our return-risk ratio was to the scaling. Our research shows that it is reasonably constant over a wide range of scaling factors.

Why all the fuss about matching portfolio risk with benchmark risk? If an investor knows how much risk to expect, we believe it should be easier carve out a place for our strategy in a portfolio. If the strategy exhibits 40% of market volatility in one year and 120% in a second year, unnecessary confusion is created about the risk profile of the strategy.

A second benefit is lower management fees for many investors. Clients who seek near market volatility can stand pat, pay their current fees and call it a day. Clients with a lower risk appetite can allocate a smaller number of dollars to the strategy and pay proportionately less in fees.

Performance Evaluation

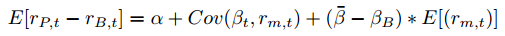

Previously, we have focused our efforts on optimizing our risk adjusted performance, but our investors are likely to evaluate our benchmark-relative performance in addition to our overall results. Regardless of our choice of benchmark, we expect our performance to be assessed as:

where:

With a couple algebraic operations we can rewrite this expression as:

The third term will be negative unless our average beta matches that of our benchmark. If our average beta is too low, our market-timing ability, the second component of our performance, has to work overtime to make us look good relative to the benchmark. By adjusting our average beta, we believe we can improve our benchmark-relative performance and show the true value of our market-timing approach.

The benefits of volatility targeting certainly seem to outweigh the risks, and we believe in delivering the best possible product for our clients. With that in mind, we always like to err on the side of caution. We plan to gradually increase our target volatility to that of the market, starting at 80% of volatility target by the end of June.

©2017 Hull Tactical Asset Allocation, LLC (“HTAA”) is a Registered Investment Adviser. The information set forth in HTAA’s market commentaries and writings are of a general nature and are provided solely for the use of HTAA, its clients and prospective clients. This information is not intended to be and does not constitute investment advice. These materials reflect the opinion of HTAA on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions. All investments are subject to risk, including the risk of loss of principal. Past performance is not a guarantee of future results. HTAA and any third parties listed or identified herein are separate and unaffiliated, are not responsible for each other’s products, policies or services, and the views expressed are their own.

LEAVE A COMMENT