-

- February 5, 2026

- 0

Volatility: The Villain of Buy and Hold, the Fuel of Active Trading

Many long-term investors claim to love volatility because it creates opportunity. This is usually said immediately after experiencing a large loss. It is a form of emotional self defense. Volatility is not good for buy and hold portfolios. It is the engine that drives drawdowns and extends the time you spend underwater.

But at the same time volatility is precisely what active traders require if they want to make meaningful returns. Without it, there is nothing to do. Volatility is both the enemy and the raw material, depending on the style. Buy and hold wants a smooth line. Traders want movement, disagreement, and mispricing.

Let’s make the contrast clear and concrete.

Volatility Punishes Buy and Hold

Suppose we simulate a simple geometric Brownian motion with the same drift but different volatilities. Increase volatility and three things immediately become obvious:

- Drawdowns grow. Even with the same long run expected return, the path becomes more violent. The typical trough deepens (roughly linearly with volatility).

- The time to recovery lengthens. This is the killer. Recovery time scales more or less exponentially with drawdown depth. A portfolio that drops twenty percent needs twenty five percent to recover. A portfolio that drops fifty percent needs one hundred percent. These are not comparable events.

- Terminal wealth spreads out. Same mean, wider distribution. The expected value hides the experience. Investors do not live in expectation space. They live in paths.

In practice, the most intuitive demonstration is the simplest simulation.

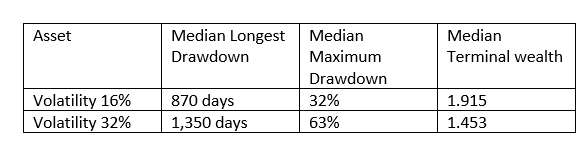

Here we take two assets with identical expected return, say eight percent (roughly the return of the US stock market). One has sixteen percent annualized volatility (one percent a day). The other has thirty-two percent (two percent a day). Run a thousand paths. The high volatility asset will:

- Spend more time in drawdown

- Take longer to get back above the previous peak

- Deliver lower median wealth despite the same expected return

Table One: Statistics for a high volatility and low volatility asset. 1000 simulations of ten-year paths.

This is why the traditional advice for long term investors boils down to “do not look at your account too often”. If you look too often you will spend a disproportionate amount of your life looking at red ink.

Volatility is the tax on patience. The higher it is, the more you pay.

Active Investors Want the Exact Opposite

Active traders need volatility the way a mill needs water. Without movement there is no edge to harvest and no reason to trade. To them, high volatility is not dangerous. It is simply busy.

There are three important reasons why traders usually do better in high volatility regimes.

- Volatility Creates Price Extremes

- Prices move farther from intrinsic value. If your process buys weakness and sells strength, you want the weakness to be meaningful. You want enough movement that cheap actually becomes cheap. Normal ranges widen. Markets overshoot. Reversal opportunities become more obvious and more frequent.

- A low volatility market produces small deviations that often do not justify the risk or paying transaction costs. A trader can go for days or weeks without anything truly interesting occurring. In high volatility, this problem disappears.

- Volatility Increases Opportunities per Unit of Time

- A trader’s return is frequency multiplied by edge. You can have a small edge if you can monetize it often. High volatility regimes compress the cycle. The market gives more setups, more signals, more trades, and more movement per calendar month.

- Two weeks of high volatility can provide more usable information than two months of quiet markets. This is one of the main reasons why volatility clustering matters. Good traders often make the bulk of their annual income in a handful of volatile episodes.

- Volatility Reflects Disagreement and Information Flow

- Volatility is not random noise. It is the manifestation of disagreement, new information, uncertainty, and forced flows. Something is happening. People are updating beliefs. Liquidity providers are adjusting. Funds are repositioning.

- When people disagree, prices move. When prices move, patterns emerge. When patterns emerge, edges can be found.

- The best active traders do not fear volatility. They fear monotony. Volatility signals that information is arriving and that some of it will be misinterpreted. That is the environment in which skill matters.

The Paradox: Investors Want Smooth Returns but Need Prices to Move

The irony is that the very movement that hurts long term portfolios is the thing that creates the long-term equity premium in the first place. Investors need to be paid for enduring volatility. Traders want to be paid for exploiting it.

The typical buy and hold investor sees volatility as a mental burden and a drag on compounding. When a market gets volatile, buy and hold investors should temper expectations. Drawdowns are natural. Recovery times stretch. The experience is uncomfortable because it is supposed to be uncomfortable.

The active trader sees volatility as inventory: a set of potential mispricings created by stress, emotion, leverage, and forced trades. This is the moment to lean forward. High volatility is not a red flag. It is an invitation. If you have a process that buys distress and sells relief, or that identifies short term inefficiencies, this is your season.

This does not mean traders always do well in volatile markets. Many do not. But the good ones tend to have their best periods when realized volatility is elevated. They have more data, more dispersion, more forced selling and forced buying, and more opportunity to take the other side of bad decisions.

Volatility is not inherently good or bad. It is simply redistributive. It hurts those who rely on the path and rewards those who rely on the deviations.

Passive investing thrives on time. Active trading thrives on movement.

Disclaimer

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting, or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact HTAA or consult with the professional advisor of their choosing.

Except where otherwise indicated, the information contained in this article is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution of any future date. Recipients should not rely on this material in making any future investment decision.

Volatility refers to the degree of variation in the price or value of a financial instrument over time. It is a statistical measure that reflects how widely returns fluctuate around an average and is commonly used as an indicator of market risk. Higher volatility indicates larger and more frequent price movements, while lower volatility indicates more stable prices.

LEAVE A COMMENT